When to Add Additional Personal Property Coverage to Your Homeowners Policy

Homeowners insurance provides liability protection and coverage for your home, and most policies include coverage for your belongings — up to a set limit. But you may still want to consider additional personal property insurance to expand your coverage options.

What does personal property insurance cover? It depends on the policy, but personal property coverage aims to protect your “stuff,” such as furniture, electronics and clothing, that may be damaged in a covered loss.

It’s an obvious question to start with: How much personal property coverage do you need? The answer depends on you. You need the amount of personal property coverage to help you repair or replace your belongings comfortably, and that depends on how much you own and how valuable the items are. You might also want to consider choosing replacement cost coverage for your belongings so if you experience a covered loss, you may be reimbursed for the full value of your items without any depreciation. If you’re trying to decide how much personal property coverage you need, start by taking a home inventory of your household items. Then, compare the total value of your belongings to your policy coverage limit.

Maybe you don’t own a lot of valuable items. If that describes you, then standard coverage that lumps all personal property together under a homeowners or renters policy may be enough coverage for you. Standard policies may also have set limits for the replacement of high-value items, such as up to $1,000 for stolen jewelry.

Your belongings may be covered under personal property insurance as long as the damage or loss occurred as a result of a covered peril or covered loss, such as a fire. (Note that flood damage is likely not covered under your policy unless you have a separate flood insurance policy.) If you need help determining whether the standard personal property coverage would be adequate in your case, reach out to your Farm Bureau agent to make sure your belongings are protected.

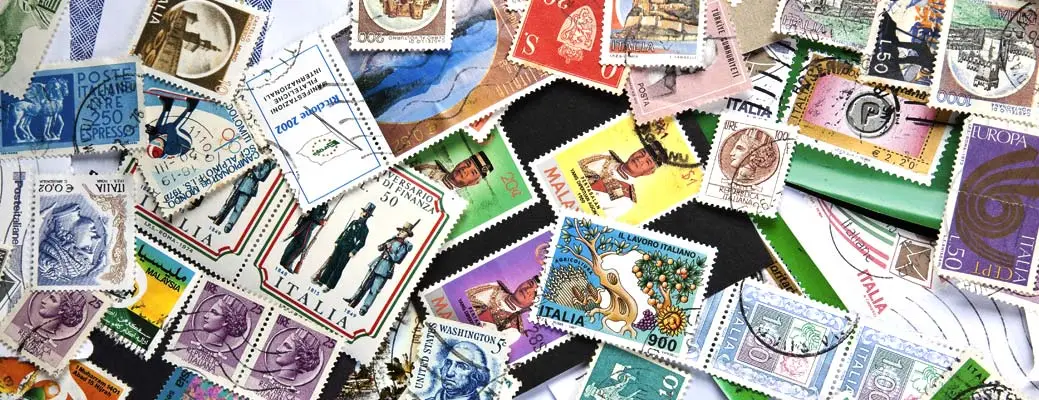

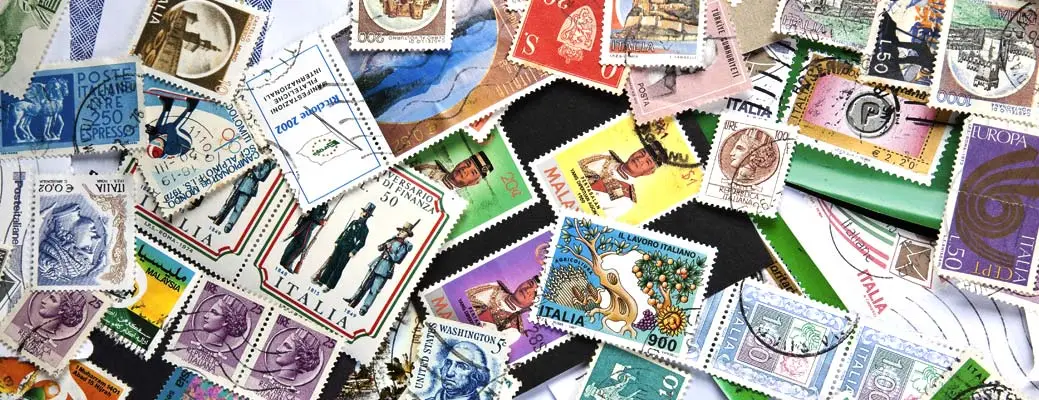

If you own fine art, jewelry or other big-ticket items, the loss of them could be hefty. And, of course, some of those items could never really be replaced. Sometimes, standard personal property insurance doesn’t go far enough, and your homeowners policy may have coverage limitations or set limits that need to be considered.

For high-value items, you may need to include a description and the value of the item and get approval to insure this type of personal property insurance. By “scheduling” certain items of higher value, you add another layer of protection to your homeowners or renters policy.

One key benefit of scheduled personal property coverage is that it often allows you to have a lower deductible on your high-value items compared to a larger deductible that may apply to your home or its contents. For example, if you would like to “schedule” your wedding ring, you could potentially have a $250 deductible on your ring. Without “scheduling” your ring, it may be subject to the deductible on your homeowners policy – which could be much higher.

An independent appraiser can assess the value of your high-ticket personal items to determine their current worth, helping you decide if you’d like to add scheduled personal property coverage to your policy. You can find a certified appraiser in your area by checking out appraiser organizations such as American Society of Appraisers or Appraisers Association of America.

Scheduled personal property coverage provides peace of mind that your high-value belongings are better protected if something happens. For additional peace of mind, consider storing valuables in a safe deposit box or secure home safe and installing an alarm system in your home. These safety features don’t just reduce the risk of theft — they may also help you get a discount on scheduled personal property coverage with certain insurance companies.

Have questions about whether your valuables are covered, or wondering if should you add them to your policy? Get in touch with your Farm Bureau agent today.